4.12. Statements

Main Information

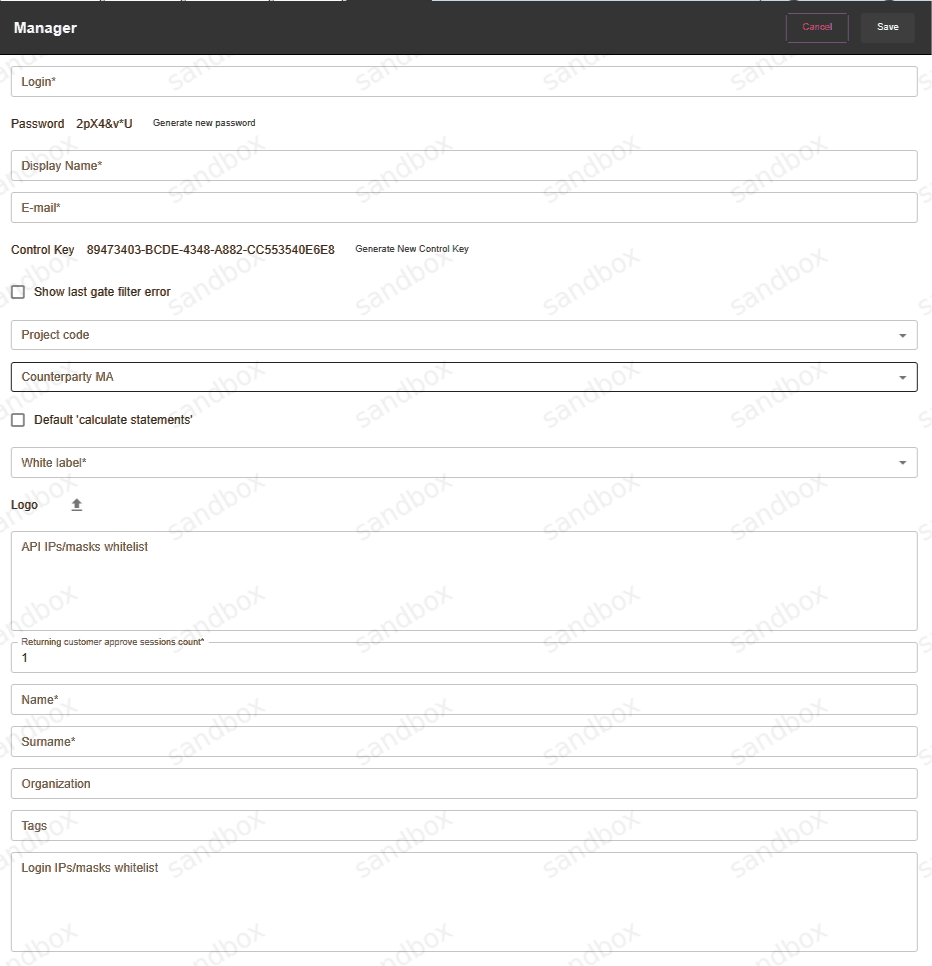

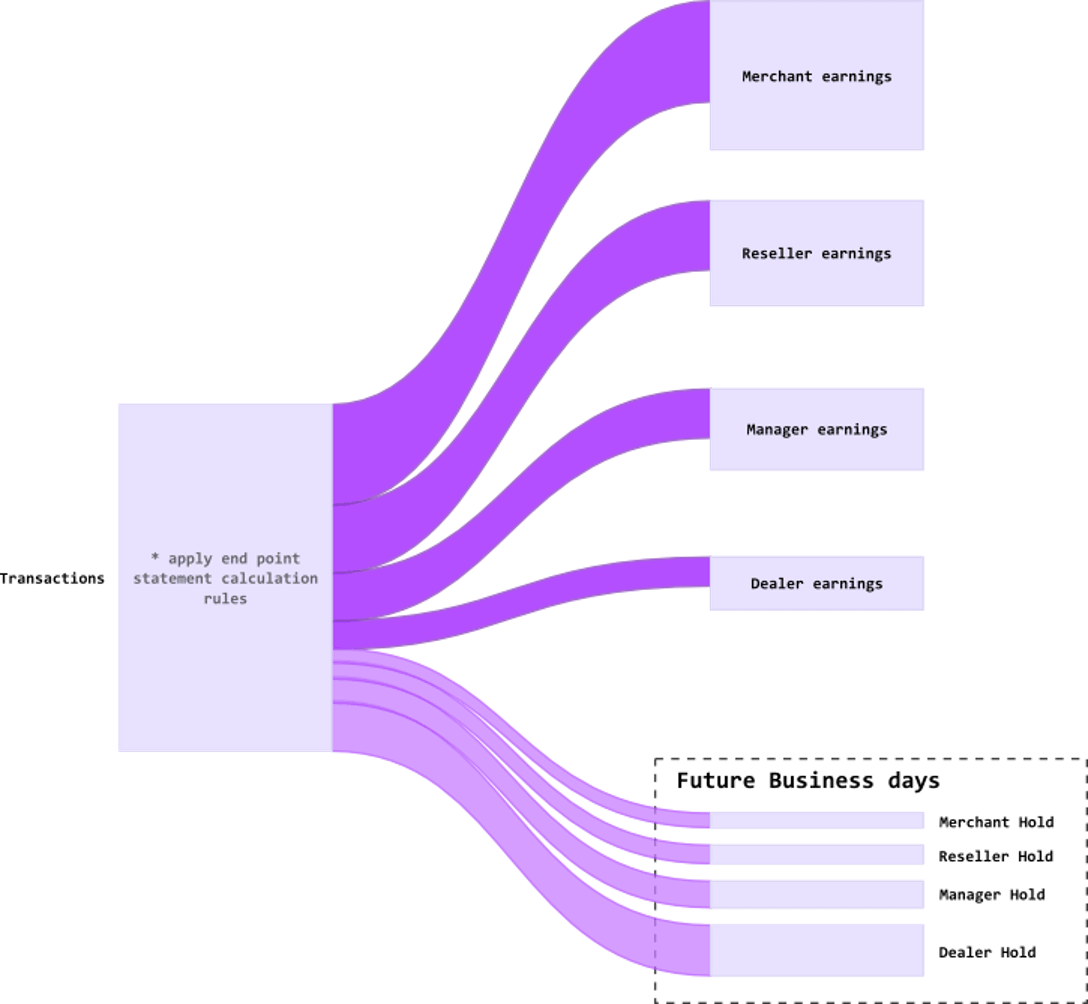

Payneteasy platform contains integrated calculation system to reflect the tariffication between business process partners. Calculation happens on each level, from dealer to merchant. Bank fees are calculated for tariffication and settlement, but statements for settlement with the bank are not provided by the system. Instead, the system calculates statements per Merchant and indicates which exact amount should be received from the bank. Statement is individually generated for each manager or each merchant of this manager. Statement date is called business day. Statement for business day contains all projects for chosen manager. Statements will be calculated for manager if such option is enabled. If statement should be calculated, enable the Default calculate statements flag in manager account details. If this option is not enabled, statements setting in projects of exact manager will be unavailable and statements are not calculated.

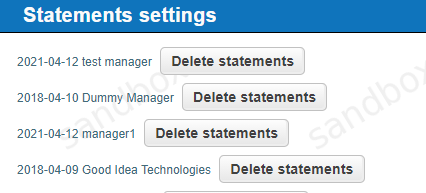

Statements can be calculated manually or automatically. Automatic statements calculation starts every 2 hours. Statements menu also has options to create new statement or delete statement that already exists.

After deleting the statement, all information about payed and frozen amounts is lost forever. Only last business day can be deleted. Deleted statements must be recalculated sequentially from a lesser date to the next. Otherwise, if statements are recalculated by jumping over several dates, then intermediate business periods will be included in one.

After deleting the statement, all information about payed and frozen amounts is lost forever. Only last business day can be deleted. Deleted statements must be recalculated sequentially from a lesser date to the next. Otherwise, if statements are recalculated by jumping over several dates, then intermediate business periods will be included in one.

Managers are able to count statements only for themselves and their merchants, superiors are also able to calculate statements for their managers. Positive balances from previous months do not carry over. Negative balances are taken into account in the current period as a balance for the beginning of the period. A separate statement is generated for each currency. If the counterparty has projects in different currencies, then several statements will be generated for each currency.

Statements Calculation Parameters

The calculation of statements begins with the definition of a list of transactions, which are included in the specified business period. All transactions are conditionally divided into the following types:

Reducing the merchant’s balance (chargeback, reversal and etc.)

Increasing the merchant’s balance (sale, capture and etc.)

The system supports Hold mechanism to determine the list of positive transactions that will be included in statement and Delay mechanism to reduce risks in settlements with counterparties.

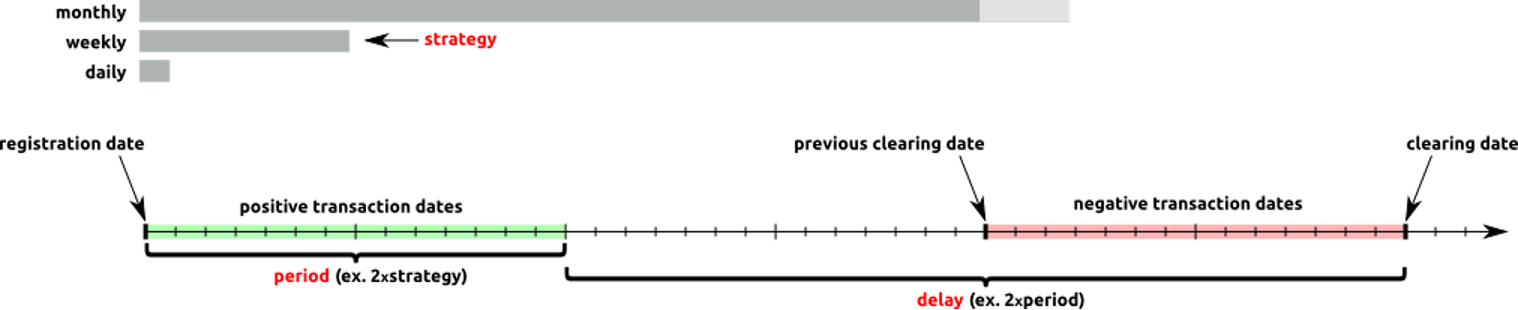

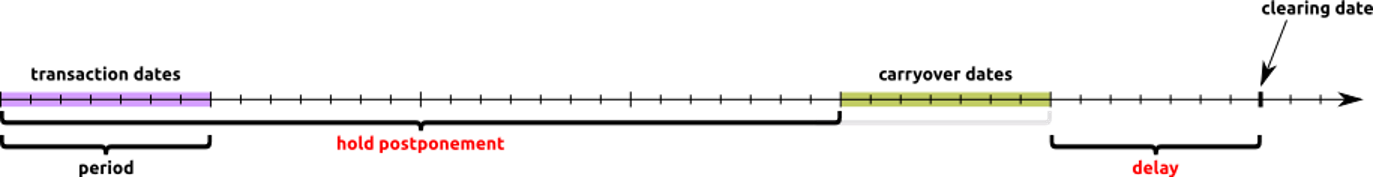

Delay

Delay — is a mechanism for short-term postponement of payments for positive transaction volumes, which allows to form a safety cushion equal to the average merchant’s turnover for the paid period. It allows to minimize the risks of negative activity during the merchant’s work.

The payment strategy, its frequency and delay can be configured on endpoint level. The following strategies are supported:

daily payments, payment periods and delay are defined in days,

weekly payments, payment periods and delays are determined in weeks, statements are generated on Mondays,

monthly payments, payment periods and delays are determined in months, statements are generated on the first day of each month.

The start date of payment period, as well as any other derivative dates obtained during the formation of statements, can not be less than the endpoint registration date.

Payment Period determines the regularity of business days. For example, if the payment strategy is weekly, and the period is two, then the statements are generated every two weeks. The minimum period is one.

Payment Delay determines the number of periods for which the funds received for positive transactions will be delayed before they are paid to the counterparty. For example, if the statements are calculated monthly with a payment period once a month, then, if the delay period is set to one period, the merchant will receive money for positive transactions for the second-to-last month, instead of the last one. The merchant will be able to receive money for the last month only next month. Negative transactions accounted in the statement ignore the delay period to minimize risks.

Statements are calculated using the latest delay parameters configured at the endpoint. This allows to recalculate the statements for the previous business days using the new parameters.

Holding

Holding — is a mechanism for medium- and long-term postponement of payments for positive transaction volumes. It allows to form a safety cushion to repay negatives received after the end of the merchant’s work.

The amount to be paid for positive transactions that is included to the statement may be partially withheld for periods comparable with dispute flow and fraud claims. Holding mechanisms are used for this purpose. Holding period and amount are specified in the rate plan. The hold period is set in days. The hold value is set in percent. It is not possible to change these values after calculating the rates for the processed transaction. Each transaction has a unique period and a holding percentage calculated on the date of its processing.

When specifying the duration of the delay, please note that the holding period, specified in the rate plan during the carryover payment, does not include the payment delay period, specified in the endpoint settings. This is done in order to avoid holding payments until the main amount is paid, with a large delay in payments and a small delay in the hold. I.e., if the holding period for the transaction is one day for daily payments with a frequency of one day and a delay of three days, the carryover for the transaction will be paid in 4 days from the moment of its processing.

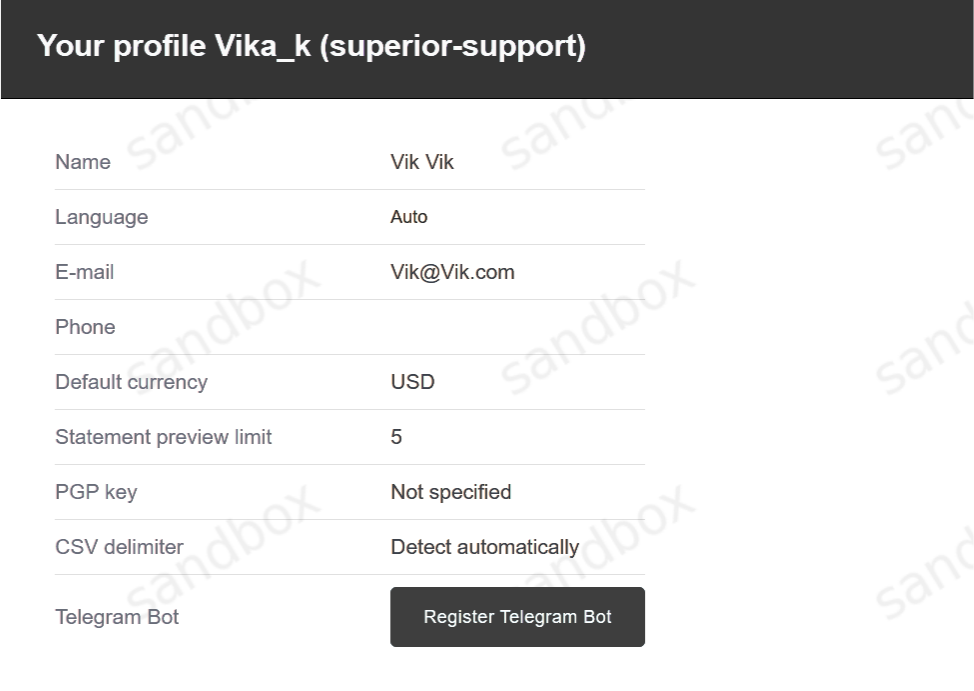

Preliminary Review Of Future Statements

It is possible to view statements for future dates before they are generated, in order to be able to predict the necessary amounts to be paid on company accounts. The number of periods for which the preview is available is set in the user profile.

The calculation of payment dates when generating the statement and its preview differs from each other. When calculating the preview dates, the delay parameters specified for the endpoint are strictly taken into account. When calculating dates during the scheduled formation of the statement, the start date of the business period is shifted to the end date of the last available business period. This feature is useful when generating statements that include several payment periods and when changing the payment period or delay. If the dates grid, obtained when calculating payment periods, differs from the actual payment dates (for example, when parameters for calculating statements are changed and statements the previous business days are not recalculated) the preview might not be available for a future date or the start dates of the period will be incorrect.

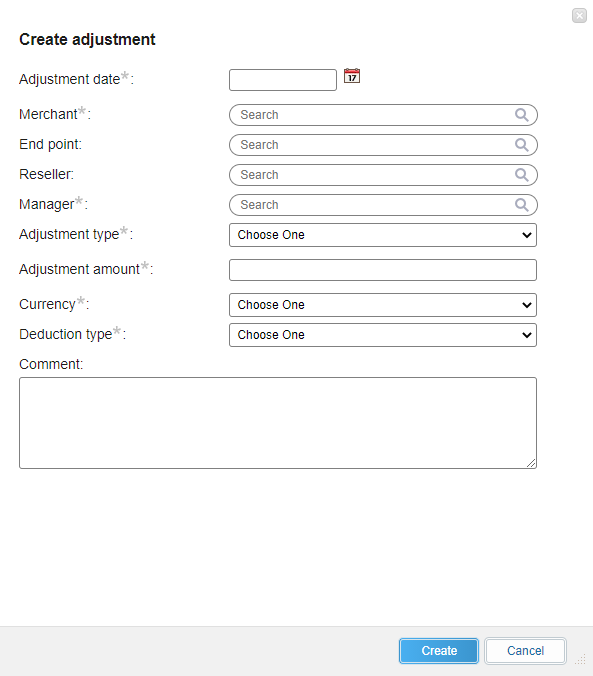

Statement Adjustments

Statements can take into account not only the transaction commission. The statement balance can be changed by means of adjustments that can be accrued for any counterparty from the dealer to the merchant. Adjustments can be applied to the statement on a special screen in the menu “Reports” – “Statements” – “Adjustments”.

There are two types of adjustments:

earnings adjustment - certainly changes the client’s balance in the current statement by the full amount of the adjustment,

carryover adjustment-changes the amount of the paid carryover for the selected number of periods.

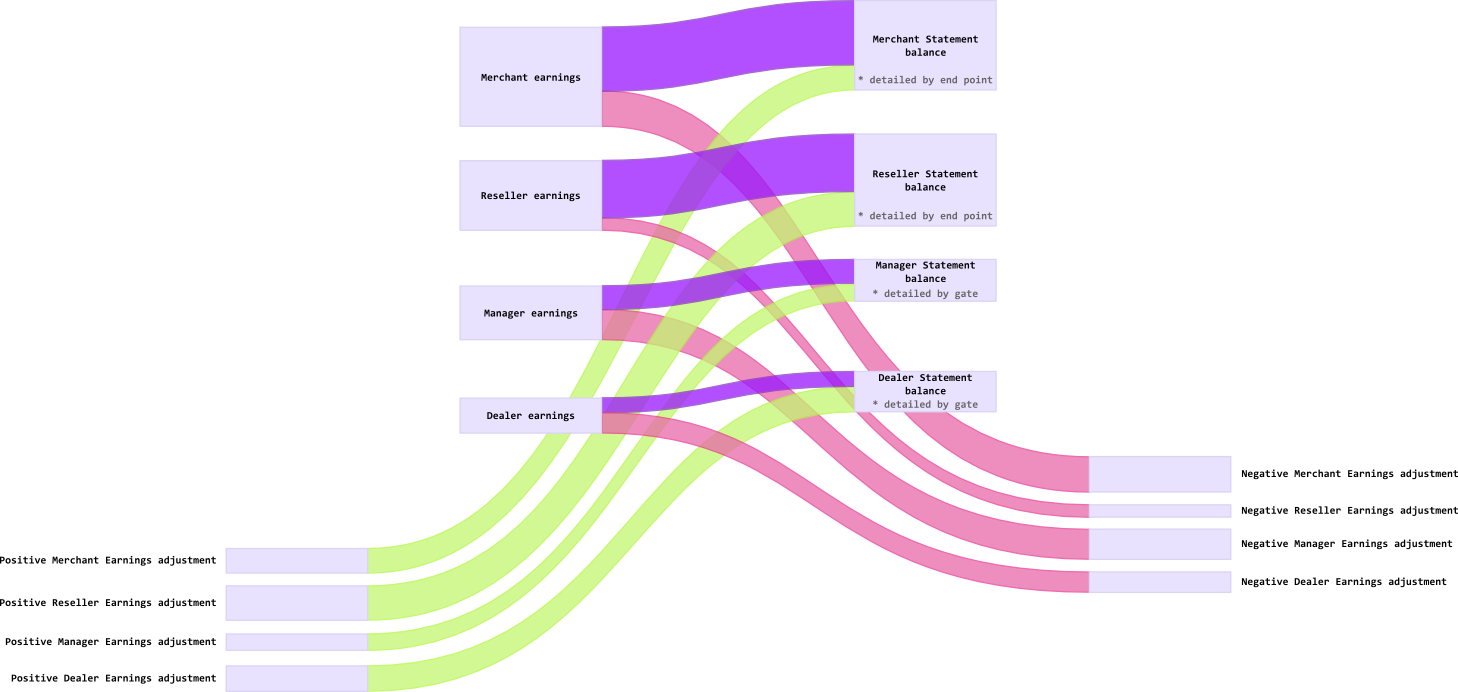

Earnings Adjustments

The adjustment of earnings can both reduce the statement balance in case of fines, and increase it in case of erroneous billing. The statement takes into account adjustments whose date is less than the date of the statement formation, which were not taken into account in earlier statements. The adjustment can be initiated with the indication of the endpoint. In this case, it will be displayed in the details of the endpoint in the statement, changing its balance. If the endpoint is not specified, the adjustment will be listed in the statement header. Statements for the merchant are generated on behalf of the reseller, if it is available on the project, for the reseller to manage the merchant’s statements. If there is no reseller, statements are generated directly from the manager. Similarly, an adjustment can be made for the merchant. If a reseller is selected when creating an adjustment, an extract will be generated on behalf of the reseller, indicating this adjustment. If the earnings adjustment is included in the statement, then it cannot be changed (except for the comment) or deleted.

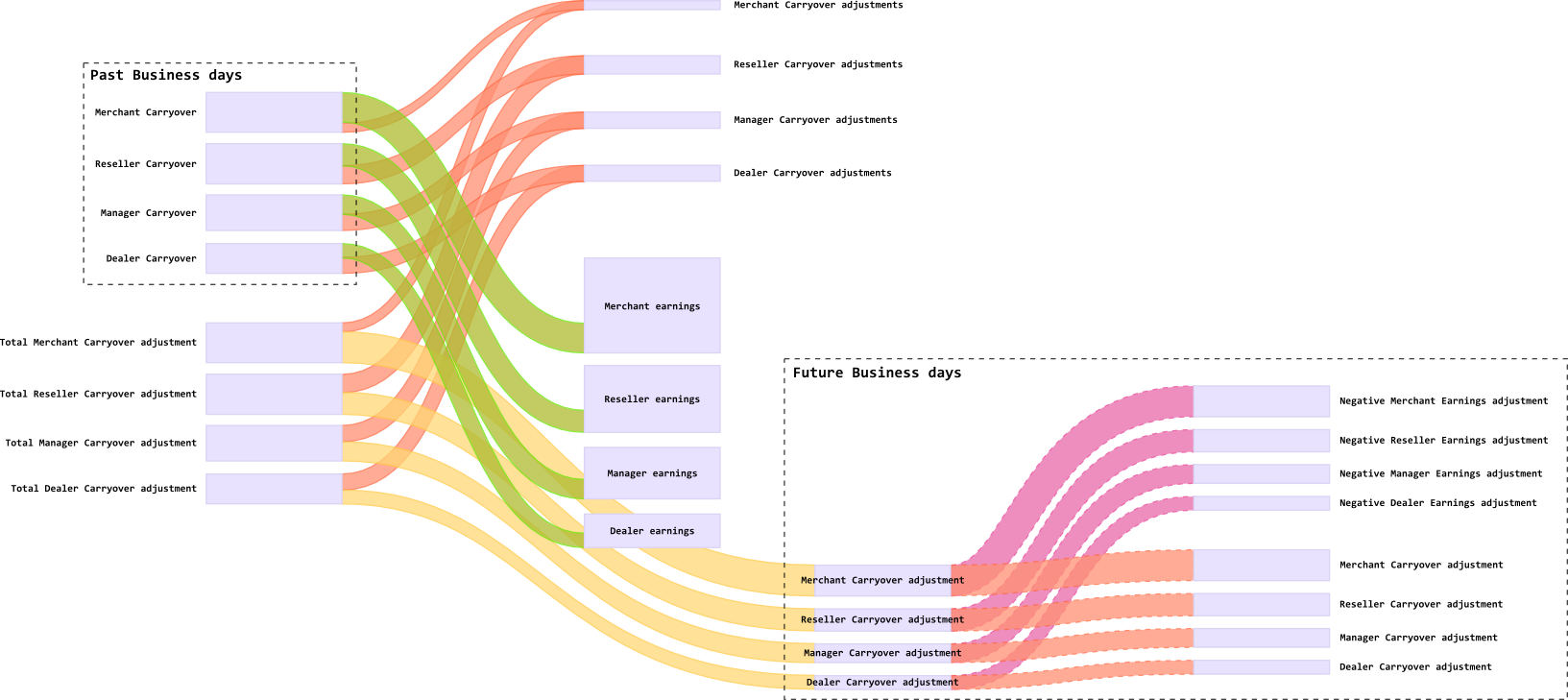

Carryover Adjustments

The second type of adjustments can only reduce the statement balance. Carryover adjustments, according to the name, are deducted from the paid hold. If an endpoint is specified when creating an adjustment, the adjustment will be deducted exclusively from the carryover of this endpoint. If the endpoint is not specified, the adjustment will reduce the entire available carryover of the merchant in exact statement. Unlike earnings adjustments, carryover adjustments can be accounted for in multiple statements. The unaccounted part of the adjustment is transferred to the calculation in the next period. The maximum number of business days in which the adjustment should be taken into account is set by the “Max deduction periods”parameter. If this parameter is zero, the number of business days to be debited is assumed to be equal to infinity. The maximum amount of application of the carryover adjustment in the current billing period is limited to the maximum amount of the carryover, if the current number of statements in which this adjustment was taken into account does not exceed the “Max deduction periods”parameter. If this parameter is exceeded, the unaccounted amount of the adjustment is converted into an earnings adjustment. Creating positive carryover adjustments in the system is prohibited.

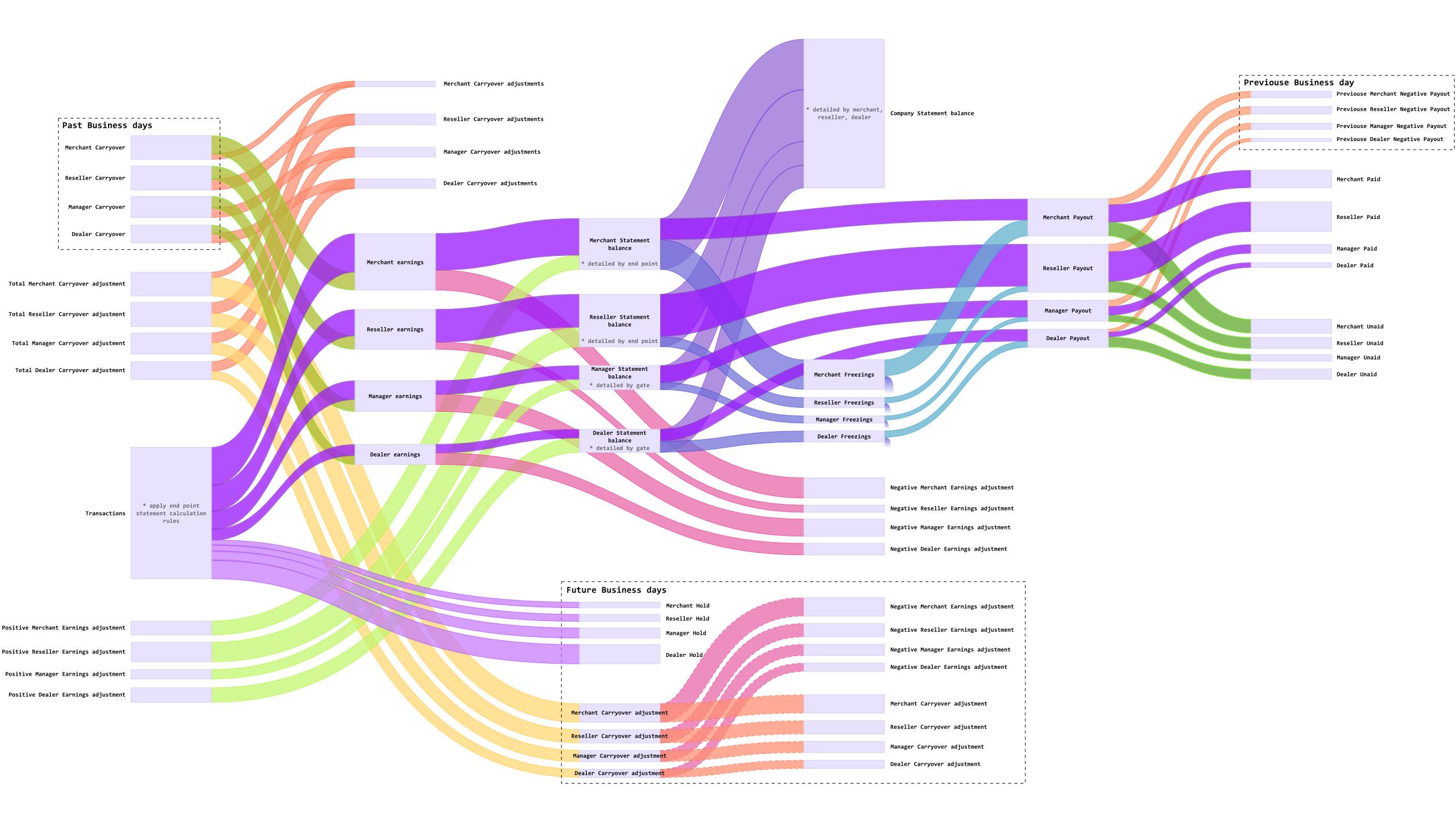

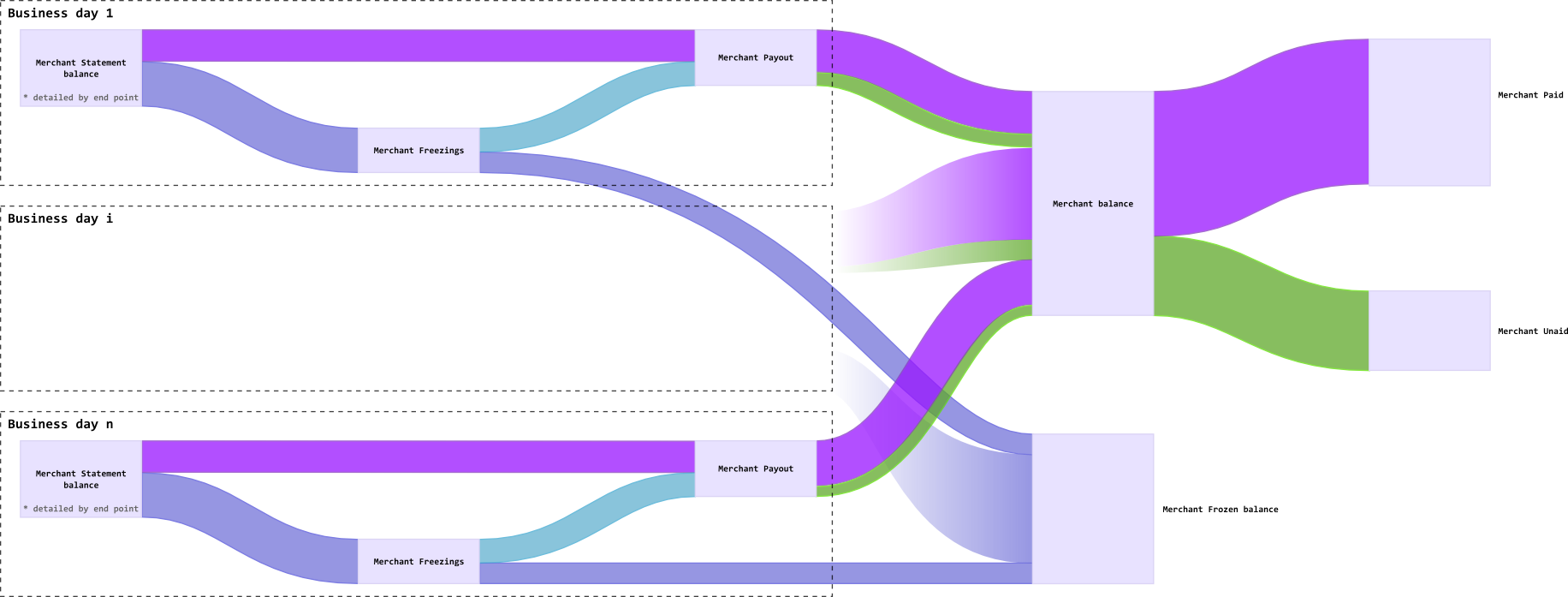

Statements Calculation Sequence

The statements are calculated in the following order:

the dealer’s statements are generated. First, the dealer’s statements are detailed by gates. Then the adjustments of the carryover paid to the dealer from the bank are applied. After that, earnings adjustments are calculated. The final balance of the current period is calculated as follows: to the difference between the bank and dealer cold, add the difference between the applied bank and dealer transaction commissions. In the final, the bank carryover is added minus the carryover adjustments and the carryover paid by the dealer is deducted.

the manager’s statements are generated, the manager’s statements are detailed by gates; adjustments are applied to the carryover paid to the manager from the dealer or the bank in his absence; earnings adjustments are calculated; the final balance of the current period is calculated as: the difference between the dealer (bank) and the manager’s hold add the difference between the applied dealer (bank) and manager transaction commissions; in the final, the dealer (bank) carryover is added minus the carryover adjustments and the carryover paid by the manager is deducted,

reseller statements are generated, reseller statements are detailed by endpoints; adjustments of the carryover paid to the reseller from the manager are applied; earnings adjustments are accrued; the final balance of the current period is calculated as: the differences of the manager’s and reseller’s hold add the difference of the applied manager’s and reseller’s transaction commissions; in the final, the manager’s carryover is added minus the carryover adjustments and the carryover paid by the reseller is deducted,

merchant statements are generated, merchant statements are detailed by terminals, indicating the reseller; adjustments are applied to the carryover paid to the merchant from the reseller or manager in his absence; earnings adjustments are accrued; the final balance of the current period is calculated as: the difference between the reseller (manager) and merchant transaction commissions applied; in the final, the reseller (manager) carryover is added minus the carryover adjustments and the amount of the merchant’s transactions excluding the amount of service operations and a Money Transfer type operation,

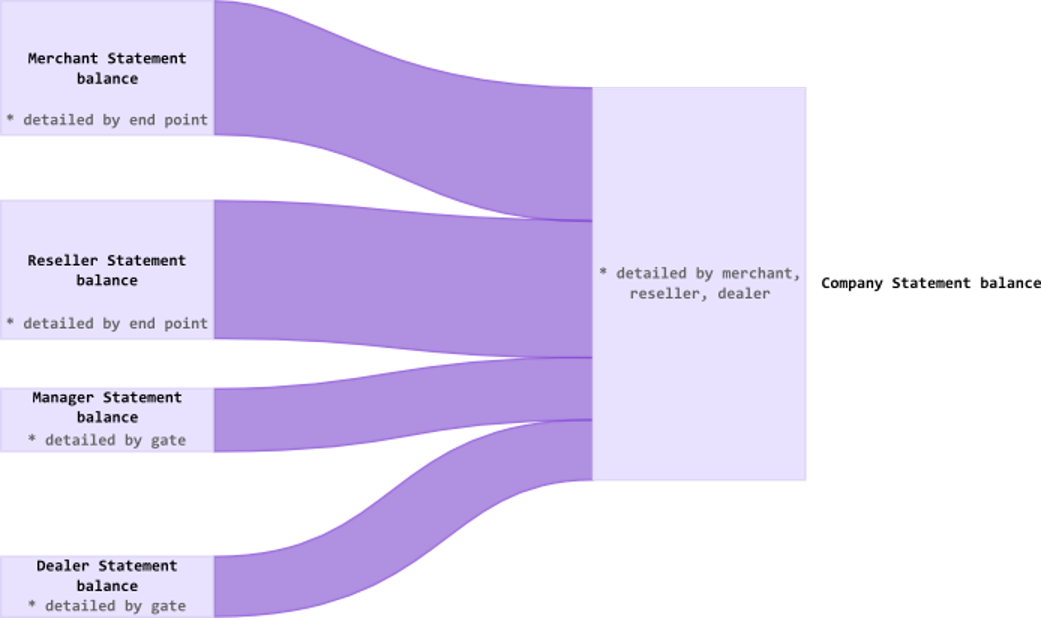

after the formation of statements for all counterparties are combined into statements for companies; statements for companies are detailed by merchant, reseller, dealer and manager, for the possibility of accounting for paid funds on the company’s balance sheet; of all the carryovers and holds, only the bank’s carryover and hold are taken into account in the company’s statements.

The calculated balance of the current period for each type of user is added to its current balance. The balance is maintained individually for each currency. For merchants, the balance is also detailed by the reseller, if available. The company’s balance sheet is not taken into account. The counterparty’s current balance is defined as the sum of the current balance of all its statements, minus paid and frozen funds.

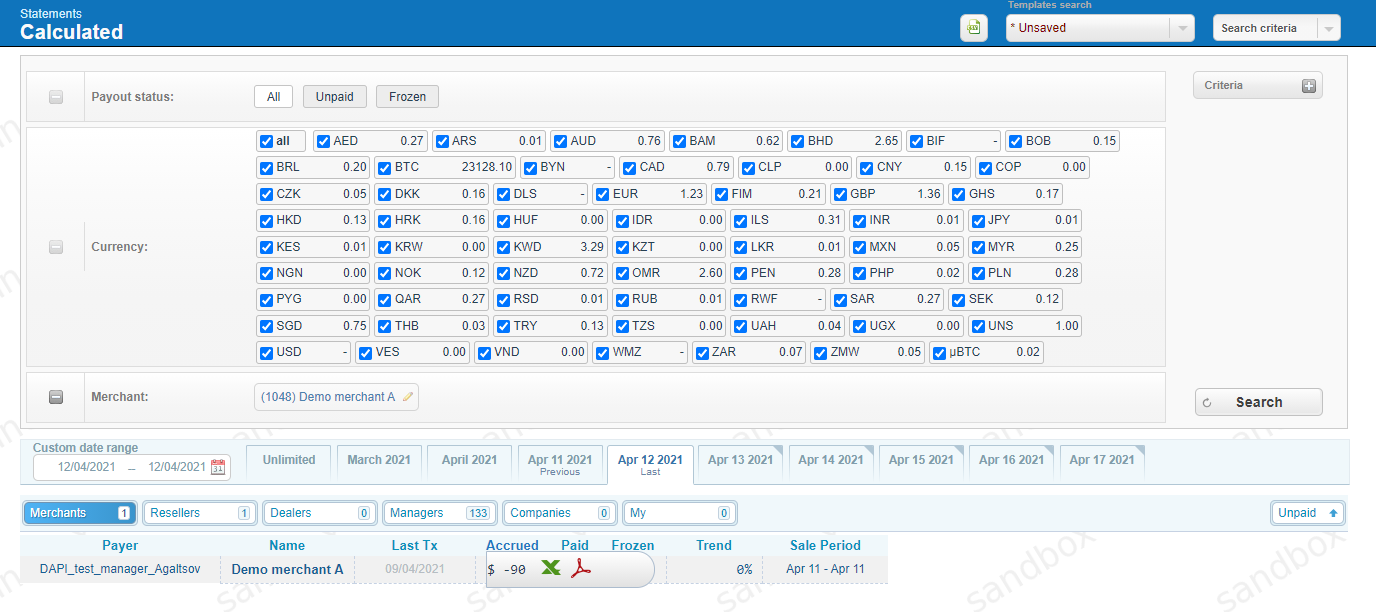

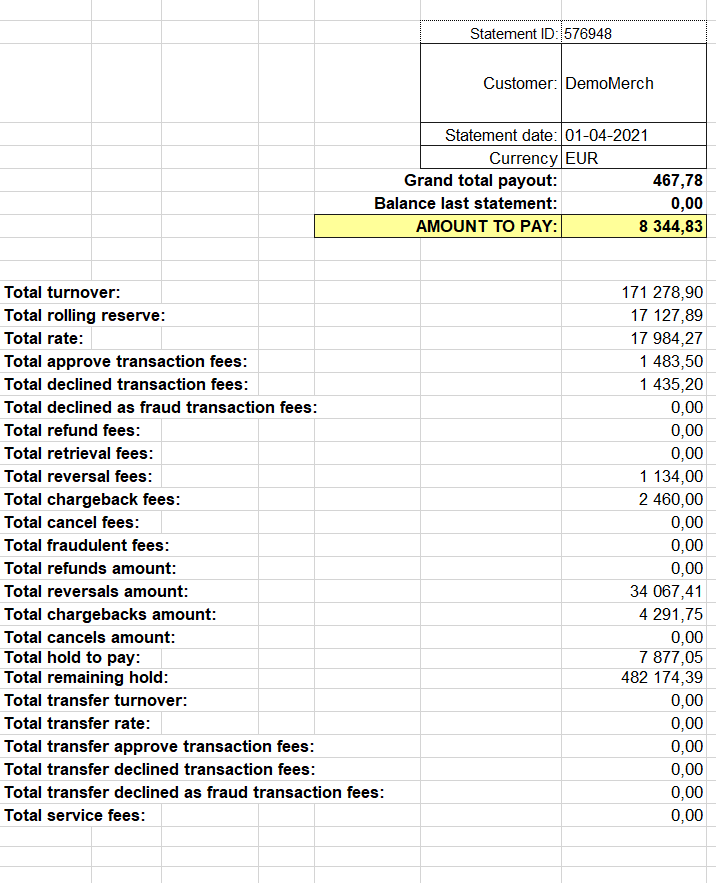

Viewing Statements

The statements are viewed in “Reports” – “Statements”. On this screen, statements can be sorted by currencies, merchants, resellers and dealers, as well as by the payment status (“All”, “Frozen”, “Not paid”) and date range. Using the date range, you can select the date of the statement that you want to upload.

The statement can be downloaded in XLS or PDF formats. To download it, click on the name of the merchant and select the appropriate format icon.

Freezing Of Payments

Frozen payment status in the advanced search can be used to manage statements for which payments have been suspended. The mechanism for freezing payments is used in cases of detecting suspicious activity of the counterparty, or receiving information from the bank about the impossibility of making payments on the current statement for unspecified reasons for an indefinite period, until any disputed issues are resolved. Frozen funds reduce the counterparty’s balance for payment. Frozen funds are managed within one business period. The amount of the frozen funds can not exceed the amount of payment of the current statement.

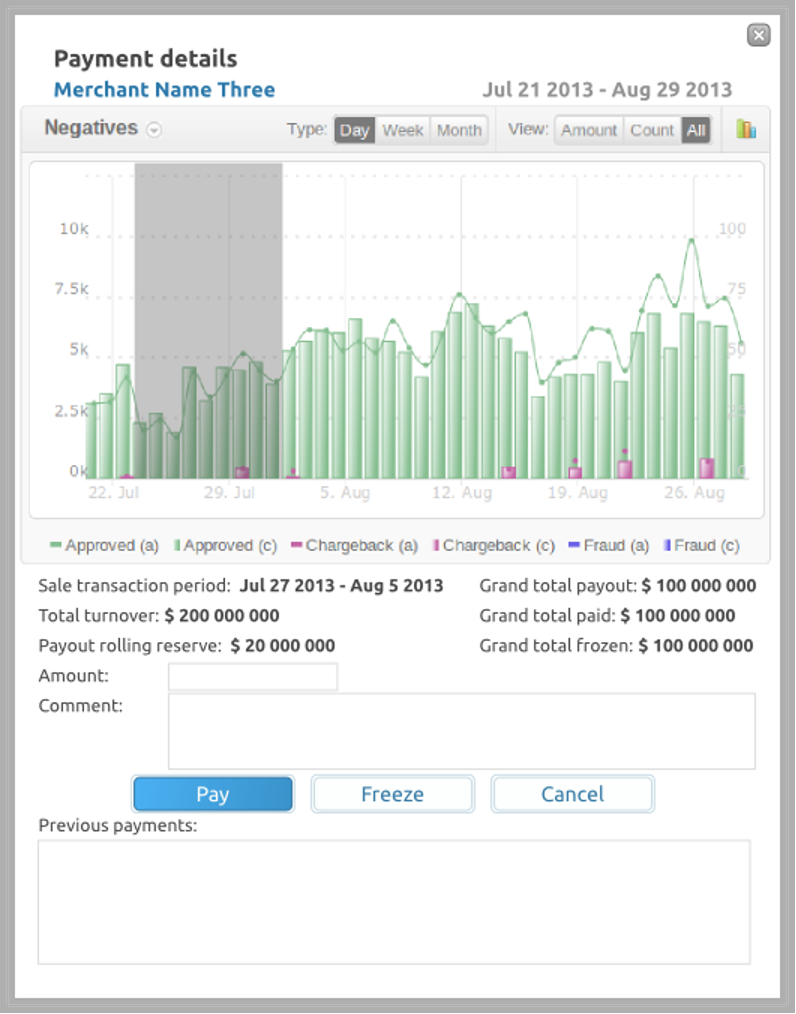

Making Payments

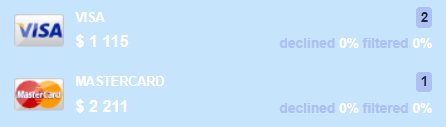

In order to minimize possible losses, relevant information is displayed in the payment window.

After clicking on the amount to be paid, the first graphical component of the analytics panel is displayed, with the following conditions:

chart type-negatives,

date range: from the beginning of the period of positive transactions included in one of the previous statements to the current date, a total of at least 5 recent periods when paying for the last business day and more when paying for the previous business days

axes — sum, quantity,

advanced search — for everyone except the merchant: the traffic of all merchants that included in this statement; for the merchant-directly the merchant; all taking into account the currency,

the graph shows an interval that displays the period of positive transactions that included in this statement,

the following data is displayed for informational purposes. According to the current statement — the period of positive transactions, the amount of transactions of the sale (capture) type, the amount of transactions of the transfer type, the number of transactions of the service type, the held hold. Total — unpaid balance, amount paid, frozen balance. A list of all payouts with a comment is also displayed.