Transaction Filters

General information

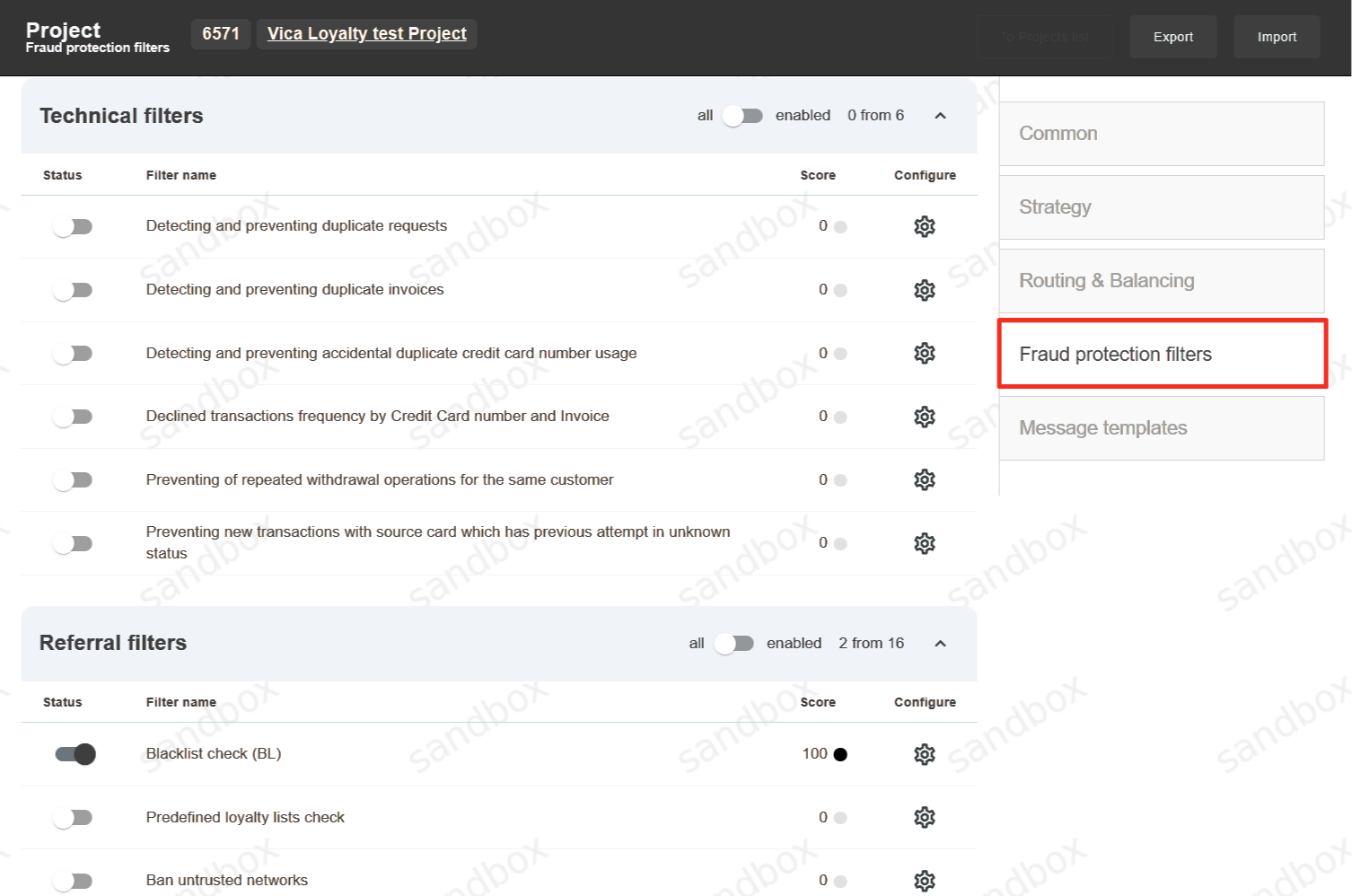

Fraud protection filters

Rule name |

Rule description |

|---|---|

Technical filters |

Technical filters compare two or more merchant requests to detect and prevent duplicate invoice payments. All filters in this category could be applied to requests in a short period of time since the moment of the transaction received by our system. |

Referral filters |

Referral checks allow to establish block and trust lists of both good and bad transaction attributes, affecting the risk score based on a known trend on many different customer attributes. |

Velocity filters |

Velocity checks allow merchants to set velocity thresholds on various customer attributes, controlling how often a customer can attempt transactions. These checks are intended to identify high-speed fraud attacks. Velocity Rules are calculated at the merchant account level. If a merchant has several merchant accounts under their company account, velocity counts do not aggregate across the entire company if not specified additionally. For example: A single credit card is used for 2 transactions in merchant account A and 3 transactions in Merchant Account B. The Velocity Rule counts 2 in Account A and 3 in Account B. An abandonment of the shopper after redirecting to a payment method or 3-D Secure is counted as an attempt and adds to the count for velocity rules as declined transaction. But not all of these abandoned attempts can be found in the payment list, it depends on the exact integration with PSP. |

Consistency filters |

Consistency checks compare two or more transaction attributes with each other. |

Custom business validations |

Additional validations and risk profiles defined by the manager. |

Technical filters

Detecting and preventing duplicate requests

Merchant request with the same request parameters will be filtered out

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Checking interval in seconds |

max interval in seconds to check duplicate request |

Type: int

Default: 15

|

Skip declined transactions |

Y - to skip sessions in Filtered or Declined status,

N - otherwise

|

Type: Enum

Default: No

|

Error codes

# |

Code |

Name |

|---|---|---|

10001 |

1007 |

Duplicate request |

Detecting and preventing duplicate invoices

Merchant request with the same client order ID will be filtered out

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Checking interval in seconds |

max interval in seconds to check duplicate invoices, set to 0 for infinity |

Type: int

Default: 30

|

Skip error transactions |

Y - to skip sessions in Error, Failed, Limited or Rejected status,

N - otherwise

|

Type: Enum

Default: Yes

|

Skip unapproved transactions |

Y - to skip to skip sessions in Filtered, Declined or Cancelled status,

N - otherwise

|

Type: Enum

Default: Yes

|

Error codes

# |

Code |

Name |

|---|---|---|

10048 |

1058 |

Duplicate invoice |

Detecting and preventing accidental duplicate credit card number usage

Customer request for the current merchant with the same credit card number will be filtered out

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Checking interval in seconds |

max interval in seconds to check duplicate credit card number usage, values more then 60 seconds are ignored |

Type: int

Default: 30

|

Skip declined transactions |

Y - to skip sessions in Filtered or Declined status,

N - otherwise

|

Type: Enum

Default: Yes

|

Error codes

# |

Code |

Name |

|---|---|---|

10087 |

1097 |

Duplicate credit card |

Declined transactions frequency by Credit Card number and Invoice

This check fires when the number of declined transactions associated with exact Credit Card number and Invoice number exceeds the configured thresholds. The time threshold is a moving window calculated backwards from the moment of the transaction, all transactions dates are truncated to minutes during window calculation. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 declines in 60 minutes, it fires on the 11th decline in 60 minutes. Counts transactions for Account verification, Sale, Preauth or Transfer transactions in the Filtered or Declined status. The limit is calculated for the current End point if parameter “for all merchant projects” set to N, or for all Merchant Projects if parameter set to Y.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

checking interval in minutes |

time frame to calculate declines count in minutes, values more then 24 hours are ignored |

Type: int

Default: 30

|

For all Merchant projects |

Y - to check transactions for all projects of the current Merchant, otherwise check transactions for current end point only |

Type: Enum

Default: No

|

Maximum declines count |

maximum number of declined or filtered transactions allowed |

Type: int

Default: 2

|

Error codes

# |

Code |

Name |

|---|---|---|

10009 |

1013 |

Too many declines for the same credit card number and invoice |

Preventing of repeated withdrawal operations for the same customer

This check fires when there is more than one transaction for one customer in a non-final status at any time. The risk fires on the second transaction if the first transaction is still in a non-final status. The filter works only for projects added to the CMS. Counts reverse transactions, payouts or transfers.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

For all merchant projects |

Yes: for all merchant projects

No: for current project only

|

Type: Enum

Default: Yes

|

Skip reversals |

Yes: reversal transactions are not taken into account

No: reversal transactions are taken into account

|

Type: Enum

Default: Yes

|

Error codes

# |

Code |

Name |

|---|---|---|

10205 |

1215 |

Repeated withdrawal request |

Preventing new transactions with source card which has previous attempt in unknown status

This check fires when customer tries to perform new card transaction while last transaction with the same source card still has non-final unknown status for past N minutes (max 1 hour). Counts Sale, Preauth or Transfer transactions in unknown status.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Checking interval in minutes |

Max interval in minutes to check existing unknown operation |

Type: Int

Default: 60

|

For all merchant projects |

Y - to check transactions for all projects of the current merchant

N - check transactions for current end point only

|

Type: Enum

Default: No

|

Error codes

# |

Code |

Name |

|---|---|---|

10259 |

1269 |

Customer card has previous transactions in unknown status |

Referral filters

When transaction is filtered by merchant blacklist, the API response message will have the following structure: “Transaction declined - please contact support with the following code: {error code}:{error #}” This message is relevant only for merchant black lists and can be displayed to the customer instead of actual filtering reason.

Blacklist check (BL)

Allows blacklisting of specified clients based on various criteria such as email, IP address, etc

Score: No

Enabled by default: Y

Parameters

Name |

Description |

Value |

|---|---|---|

For all merchant projects |

Y - to check blacklists for all projects of the current merchant, otherwise check blacklists for current project only |

Type: Enum

Default: Yes

|

Error codes

# |

Code |

Name |

|---|---|---|

10137 |

1147 |

Billing country blacklisted for merchant |

10138 |

1148 |

IP-address country blacklisted for merchant |

10139 |

1149 |

Customer e-mail blacklisted for merchant |

10140 |

1150 |

Customer fingerprint blacklisted for merchant |

10141 |

1151 |

Customer ip-address blacklisted for merchant |

10142 |

1152 |

Customer purpose blacklisted for merchant |

10143 |

1153 |

Destination card bin blacklisted for merchant |

10144 |

1154 |

Destination card country blacklisted for merchant |

10145 |

1155 |

Destination card number blacklisted for merchant |

10146 |

1156 |

Destination card type blacklisted for merchant |

10147 |

1157 |

E-mail domain blacklisted for merchant |

10148 |

1158 |

Source card bin blacklisted for merchant |

10149 |

1159 |

Source card country blacklisted for merchant |

10150 |

1160 |

Source card number blacklisted for merchant |

10151 |

1161 |

Source card type blacklisted for merchant |

10156 |

1166 |

Customer e-mail blacklisted for manager |

10157 |

1167 |

Customer fingerprint blacklisted for manager |

10158 |

1168 |

Customer ip-address blacklisted for manager |

10159 |

1169 |

Customer purpose blacklisted for manager |

10160 |

1170 |

Destination card number blacklisted for manager |

10161 |

1171 |

E-mail domain blacklisted for manager |

10162 |

1172 |

Source card number blacklisted for manager |

10169 |

1179 |

Customer e-mail + source card number blacklisted for merchant |

10194 |

1204 |

Source card mask blacklisted for merchant |

10195 |

1205 |

Destination card mask blacklisted for merchant |

10196 |

1206 |

Source card mask blacklisted for manager |

10197 |

1207 |

Destination card mask blacklisted for manager |

Predefined loyalty lists check

Allows processing for trusted customers only. Different merchants have different definitions of a trusted customer, this filter allows processing for customers with emails, source/destination card or purpose in corresponding loyalty lists only. Transactions for customers that are not listed in any loyalty list will be filtered out. Filter will be applied for chosen countries only, for all other countries check will be ignored.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

BIN country identifier |

* |

Type: List

Default: *

|

For all merchant projects |

Y - to check customer email in email anti-blacklists for all projects of the current merchant, otherwise check in email list for current project only |

Type: Enum

Default: Yes

|

Ignore check for account type |

* |

Type: String

Default: *

|

Ignore check for bank id list |

* |

Type: String

Default: *

|

IP country identifier |

apply filter for selected countries only, country defined by customer IP |

Type: List

Default: *

|

Error codes

# |

Code |

Name |

|---|---|---|

10152 |

1162 |

Merchant loyal customer e-mail check failed |

10153 |

1163 |

Merchant loyal customer purpose check failed |

10154 |

1164 |

Merchant loyal destination card number check failed |

10155 |

1165 |

Merchant loyal source card number check failed |

10163 |

1173 |

Manager loyal customer e-mail check failed |

10164 |

1174 |

Manager loyal customer purpose check failed |

10165 |

1175 |

Manager loyal destination card number check failed |

10166 |

1176 |

Manager loyal source card number check failed |

10168 |

1178 |

Merchant loyal customer e-mail + source card number end check failed |

10183 |

1193 |

Merchant loyal customer e-mail + source card number check failed |

10184 |

1194 |

Merchant loyal customer phone + source card number check failed |

10185 |

1195 |

Merchant loyal customer purpose + source card number check failed |

10186 |

1196 |

Merchant loyal customer fingerprint + source card number check failed |

10193 |

1203 |

Transaction declined - please contact support with the following code: 1203:10193 |

10260 |

1270 |

Manager loyal destination card mask check failed |

10261 |

1271 |

Merchant loyal source card mask check failed |

10262 |

1272 |

Merchant loyal destination card mask check failed |

10263 |

1273 |

Manager loyal source card mask check failed |

Ban untrusted networks

Allows to make block lists based on the specific IP address ranges of the customer. Merchants are able to submit IP address ranges in either IPv4 or IPv6 format via CSV upload.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Customer ip ranges |

file format example:

192.168.0.0, 192.168.255.255

fd00:0000:0000:0000:0000:0000:0000:0000, fdff:ffff:ffff:ffff:ffff:ffff:ffff:ffff

|

Type: File |

Error codes

# |

Code |

Name |

|---|---|---|

10034 |

1044 |

Untrusted network |

Credit Card Whitelist check (WL)

Allows ignoring all other fraud filters for selected credit cards. Sometimes customer’s behavior can lead to the unfortunate situation where a shopper is completely unable to process transactions. You can whitelist a customer’s credit card so they can successfully process their transaction. White list will be applied only before total transactions amount for the last month for this credit card will not reach the limit specified by filter parameters. White list could be specified for: the exact source card number by manager and merchant, the exact destination card number by merchant or the whole source card number issuer BIN range.

Score: N/A

Enabled by default: Y

Parameters

Name |

Description |

Value |

|---|---|---|

For all merchant projects |

current total transactions amount for the last month for this credit card value would be calculated, - Y: for all projects, - 3D: for 3D gates only, - Non3D: for non 3D gates only, - N: for current project only of the current merchant and converted to current project currency to compare with “up to amount” value |

Type: Enum

Default: Yes

|

Subtract Cancel transactions |

* |

Type: Enum

Default: Yes

|

Up to amount |

maximum total transactions amount for the last month for this credit card to allow credit card to be whitelisted, if this limit reached - whitelist will be ignored |

Type: Decimal

Default: 99999999

|

Customer fingerprint

Score: Yes

Enabled by default: N

Parameters

Name |

Value |

|---|---|

Add to black list threshold |

Type: Decimal

Default: 10.0

|

Block transaction threshold |

Type: Decimal

Default: 3.5

|

Error codes

# |

Code |

Name |

|---|---|---|

10035 |

1045 |

Fraud suspicious activity |

10039 |

1049 |

Fraud suspicious activity |

Check reader entry mode

If reader entry mode not in allowed list and this list is configured - filter declines transaction

Score: No

Enabled by default: N

Error codes

# |

Code |

Name |

|---|---|---|

10088 |

1098 |

Incorrect reader entry mode |

IP address Country check

This referral list allows the merchant to process transactions only for selected countries based on country of the customer IP address. Requests from IP addresses listed in “Merchant API IP address” are ignoring this check.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Country identifier |

comma separated country identifiers list |

Type: List |

Error codes

# |

Code |

Name |

|---|---|---|

10014 |

1024 |

Country not in trust list |

Issuer Country check

This referral list allows the merchant to process transactions only for selected countries based on issuing country of the card. Requests from IP addresses listed in “Merchant API IP address” are ignoring this check. Check applied for both Source and Destination card numbers.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Country identifier |

comma separated country identifiers list |

Type: List |

Error codes

# |

Code |

Name |

|---|---|---|

10015 |

1025 |

Issuer country not in trust list |

Billing Country check

This referral list allows the merchant to process transactions only for selected countries based on billing country of the customer. Requests from IP addresses listed in “Merchant API IP address” are ignoring this check.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Country identifier |

comma separated country identifiers list |

Type: List |

Error codes

# |

Code |

Name |

|---|---|---|

10112 |

1122 |

Billing country not in trust list |

IP address Country blacklist

This referral list allows the merchant to make block lists based on country of the customer IP address. Requests from IP addresses listed in “Merchant API IP address” are ignoring this check.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Country identifier |

comma separated country identifiers list |

Type: List |

Error codes

# |

Code |

Name |

|---|---|---|

10028 |

1038 |

Country in blacklist |

Issuer Country blacklist

This referral list allows the merchant to make block lists based on issuing country of the card. Requests from IP addresses listed in “Merchant API IP address” are ignoring this check. Check applied for both Source and Destination card numbers.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Country identifier |

comma separated country identifiers list |

Type: List |

Error codes

# |

Code |

Name |

|---|---|---|

10027 |

1037 |

Issuer country in blacklist |

Billing Country blacklist

This referral list allows the merchant to make block lists based on billing country of the customer. Requests from IP addresses listed in “Merchant API IP address” are ignoring this check.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

Country identifier |

comma separated country identifiers list |

Type: List |

Error codes

# |

Code |

Name |

|---|---|---|

10113 |

1123 |

Billing country in blacklist |

Issuer Country blacklist by Payment method

This referral list allows the merchant to make block lists based on issuing country of the card for selected payment method. Requests from IP addresses listed in “Merchant API IP address” are ignoring this check. Check applied for both Source and Destination card numbers.

Score: N/A

Enabled by default: N

Parameters

Name |

Value |

|---|---|

Type: List

Default: -

|

Error codes

# |

Code |

Name |

|---|---|---|

10123 |

1133 |

Issuer country in blacklist for selected payment method |

Transaction amount check

This check can be used to apply higher risk scores to transactions based on the transaction amount.

Score: Yes

Enabled by default: N

Parameters

Name |

Value |

|---|---|

Transaction amount |

Type: Decimal

Default: 0.0

|

Error codes

# |

Code |

Name |

|---|---|---|

10032 |

1042 |

Incorrect transaction amount |

Source Credit Card type check

This referral list allows the merchant to process transactions only for selected Source Credit Card types. Counts Sale and Transfer transactions.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

forbidden card level types |

comma separated card level type list. Typical card types: PREPAID, REWARDS, VIRTUAL, CASH, ATM, STANDARD, CLASSIC, GOLD, SIGNATURE, PLATINUM, ELECTRON, CORPORATE, BUSINESS, WORLD, DEBIT and variations like GOLD REWARDS, WORLD CORPORATE, etc. |

Type: String

Default: PREPAID, REWARD, CORPORATE, BUSINESS

|

Error codes

# |

Code |

Name |

|---|---|---|

10127 |

1137 |

Unsupported product type |

Destination Credit Card type check

This referral list allows the merchant to process transactions only for selected Destination Credit Card types. Counts Sale and Transfer transactions.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

forbidden card level types |

comma separated card level type list. Typical card types: PREPAID, REWARDS, VIRTUAL, CASH, ATM, STANDARD, CLASSIC, GOLD, SIGNATURE, PLATINUM, ELECTRON, CORPORATE, BUSINESS, WORLD, DEBIT and variations like GOLD REWARDS, WORLD CORPORATE, etc. |

Type: String

Default: PREPAID, REWARD, CORPORATE, BUSINESS

|

Error codes

# |

Code |

Name |

|---|---|---|

10129 |

1139 |

Unsupported destination product type |

Consistency filters

Check customer data

If one of the stop words contains in cardholder name or firstname/last name OR if cardholder name or firstname/lastname match the specified regexp OR if customer data failed basic validation rules (in case the validation flag is turned on) - filter declines transaction.

Score: Yes

Enabled by default: N

Parameters

Name |

Value |

|---|---|

Apply basic validation rules |

Type: Enum

Default: Y

|

Check if customer first name and last name are equal |

Type: Enum

Default: N

|

Check if customer first name contains last name |

Type: Enum

Default: N

|

Check if customer last name contains first name |

Type: Enum

Default: N

|

Deny regexp |

Type: String

Default: *

|

Min customer first name length |

Type: Int

Default: 0

|

Min customer last name length |

Type: Int

Default: 0

|

Stop word list |

Type: String

Default: *

|

Customer IP address Country differs from Issuing Country

This risk check is triggered when a transaction has the сustomer IP country different from the issuing country of the card. Requests from IP addresses listed in “Merchant API IP address” are ignoring this check. If parameter “apply for countries” is empty, filter will require strict customer country to issuer country matching for all the countries, otherwise this check will force country matching for listed countries only. For example if you setup “apply for countries” to US - check will be triggered for following country combinations US-anyNonUS or anyNonUS-US, but for combinations anyNonUS-anyNonUS and US-US the check will not fire. For card2card transactions issuer country of the source card should be equal to issuer country of the destination card, i.e. this check will be triggered for any cross-border transaction.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

apply for countries |

if current parameters are not empty, check will be applied for listed countries only |

Type: List

Default: 0

|

ignore undefined countries |

ignore check if country of the customer or issuer could not be defined |

Type: Enum

Default: Y

|

skip country identifier |

ignore check for specific customer country, for example check could be skipped if customer uses mobile network with Opera browser proxy to process the transaction |

Type: List

Default: 0

|

Error codes

# |

Code |

Name |

|---|---|---|

10013 |

1023 |

Country of the customer does not correspond to the country of the issuer |

Customer name differs from Cardholder name

This check fires when the provided customer name does not match cardholder name.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

greatest levenshtein distance |

greatest levenshtein distance to consider customer and cardholder names equal |

Type: Int

Default: 3

|

Error codes

# |

Code |

Name |

|---|---|---|

10114 |

1124 |

Customer name does not correspond to the cardholder name |

Customer IP address differs from IP address used for 3-D Secure validation

This check fires when the provided Customer IP address does not match IP address used for 3-D Secure validation. Sometimes fraudsters are changing the destination of the payment converting sale operatons (revocable operation) to card2card transfers to their own cards (irrevocable operation). To exclude the automation of such fraud cases this filter could be used. Some providers are using dynamic IP addresses for their clients and during transaction processing customer IP address might be changed slightly. To avoid false positives in such cases IP address change in /24 subnet is allowed.

Score: Yes

Enabled by default: N

Error codes

# |

Code |

Name |

|---|---|---|

10070 |

1080 |

Customer IP address have been changed during transaction processing |

Customer birthday check

This check fires when the provided customer birthday is in incorrect format or customer is too young or too old to perform requested operation.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

date format |

input format for customers birthday, following macros are allowed - %Y Year, numeric, four digits - %m Month, numeric (00..12) - %d Day of the month, numeric (00..31) |

Type: String

Default: %Y%m%d

|

maximum age |

maximum client age to process the transaction |

Type: Int

Default: 100

|

minimum age |

minimum client age to process the transaction |

Type: Int

Default: 16

|

Error codes

# |

Code |

Name |

|---|---|---|

10086 |

1096 |

Invalid customer birthday |

Source Credit Card number expiration date check

This check fires when the provided Source Credit Card expiration date will expire soon. The time threshold is a moving window calculated backwards from the moment of the transaction. Usually card expires in the last day of the expiration month printed on card. Check could be used to avoid acceptance of the Credit Card for future preauthorized payments if it expires before the the last recurring payment planned.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

minimum days before card expiration |

minimum days before card expiration date |

Type: Int

Default: 0

|

Error codes

# |

Code |

Name |

|---|---|---|

10126 |

1136 |

Card expires too soon |

The 6+4 customer cards differs from the 6+4 passed in purpose

This check fires when the provided Customer 6+4 card does not match 6+4 passed in purpose. Counts Sale and Preauth transactions in any status.

Score: Yes

Enabled by default: N

Error codes

# |

Code |

Name |

|---|---|---|

10249 |

1259 |

Customer card 6+4 does not match the purpose |

Custom business validations

Transaction amount changing for Purpose

This check fires when the Transaction amount changing associated with exact Purpose exceeds the configured thresholds. The time threshold is a moving window calculated backwards from the moment of the transaction. So, if you set a quantity threshold of 10 transactions in 30 days, only 10 transactions with amount fitting parameter regexp below will be allowed, starting from 11th transactions its amount should fit regexp after parameter value. Counts Account verification, Sale, Preauth or Transfer transactions in Approved status.

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

for all merchant projects |

Y - to check transactions for all projects of the current merchant, otherwise check transactions for current project only |

Type: Enum

Default: N

|

lookup period in days |

lookup period to analyse transaction amount velocity in days |

Type: int

Default: 30

|

quantity threshold |

since specified threshold all transaction amounts should fit “regexp after” parameter value |

Type: int

Default: 99999

|

regexp after |

regular expression value to fit all transaction amounts, staring from “quantity threshold” parameter value |

Type: String

Default: ^(2[5-9][0-9]|[3-9][0-9] {2}|[1-9][0-9]{3,10})([.] [0-9]{0,3})?$

|

regexp below |

if transaction amount fits this parameter value, “quantity threshold” current value increased by one |

Type: String

Default: ^([0-9]{1,2}| 1[0-9]{2}| 2[0-4][0-9])([.][0-9] {0,3})?$

|

Error codes

# |

Code |

Name |

|---|---|---|

10080 |

1090 |

Invalid transaction amount |

MCC 6211 restrictions

Security Brokers/Dealers

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

allow Australia |

allows Australia processing |

Type: Enum

Default: N

|

allow France |

allows France processing |

Type: Enum

Default: N

|

allow Jamaica |

allows Jamaica processing |

Type: Enum

Default: N

|

allow MasterCard for NA |

allows MasterCard processing for North America |

Type: Enum

Default: N

|

allow Netherlands |

allows Netherlands processing |

Type: Enum

Default: N

|

allow Uganda |

allows Uganda processing |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10099 |

1109 |

MCC 6211 rules violation |

MCC 7995 restrictions

Betting/Casino Gambling

Score: No

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

allow Germany |

allows Germany processing |

Type: Enum

Default: N

|

allow UK |

allows United Kingdom processing |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10124 |

1134 |

MCC 7995 rules violation |

CDB processing restrictions

Deny all countries except USA and EU countries. Also deny the foloowing EU countries: Austria, Belgium, Denmark, Malta, Portugal, Romania, Slovakia, Estonia, Latvia; and the following US satates: Alabama, Georgia, Missouri, South Dakota, Nebraska, California, North Carolina, Florida.

Score: No

Enabled by default: N

Parameters

Name |

Value |

|---|---|

check credit card BIN country |

Type: Enum

Default: Y

|

check customer billing address country |

Type: Enum

Default: Y

|

check customer IP country |

Type: Enum

Default: Y

|

Error codes

# |

Code |

Name |

|---|---|---|

10167 |

1177 |

CDB processing restrictions violation. |

Velocity filters

Source Credit Card Number decline frequency for last 24 hours (daily decline limit)

This check fires when the number or amount of declined transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Account verification, Sale, Preauth or Transfer transactions in the Declined status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 24 hours for this credit card used as Source card |

Type: Decimal

Default: 999999999

|

For all merchant projects |

current total transactions amount or count for the last 24 hours for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 24 hours for this credit card used as Source card |

Type: Int

Default: 99999

|

Use calendar days |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10083 |

1093 |

Daily decline amount limit exceeded for sender |

10084 |

1094 |

Daily decline quantity limit exceeded for sender |

Source Credit Card Number increasing sequence of approved transaction amounts for last 24 hours (daily rising limit)

This check fires when the number of approved transactions with increasing amount associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 increasing transactions, it fires on the 11th increasing transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the Approved status. This check only cross-checks transactions within the same merchant account in the same project.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

quantity limit |

maximum transactions count with increasing amount for the last 24 hours for this credit card number |

Type: Int

Default: 99999

|

Error codes

# |

Code |

Name |

|---|---|---|

10022 |

1032 |

Too many transactions with increasing amounts for sender |

Source Credit Card Number usage frequency for last 24 hours (daily limit)

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 24 hours for this credit card used as Source card |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last 24 hours for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 24 hours for this credit card used as Source card |

Type: Int

Default: 99999

|

skip payouts |

allows to process Payout transactions even when the count or amount exceeds the thresholds |

Type: Enum

Default: N

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar day |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10016 |

1026 |

Daily amount limit exceeded for sender |

10017 |

1027 |

Daily quantity limit exceeded for sender |

Source Credit Card Number usage frequency for last 7 days (weekly limit)

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 7 days for this credit card used as Source card |

Type: Decimal

Default: 999999999

|

calendar week starts from Sunday |

“Y”: calendar week starts from Sunday,

“N”: calendar week starts from Monday

|

Type: Enum

Default: N

|

for all merchant projects |

current total transactions amount or count for the last 7 days for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 7 days for this credit card used as Source card |

Type: Int

Default: 99999

|

skip payouts |

allows to process Payout transactions even when the count or amount exceeds the thresholds |

Type: Enum

Default: N

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar week |

“Y” For calculation using calendar weeks instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10018 |

1028 |

Weekly amount limit exceeded for sender |

10019 |

1029 |

Weekly quantity limit exceeded for sender |

Source Credit Card Number usage frequency for last month (monthly limit)

This check fires when the number or amount of transactions associated with exact Source credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last one month for this credit card used as Source card |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last one month for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last one month for this credit card used as Source card |

Type: Int

Default: 99999

|

skip payouts |

allows to process Payout transactions even when the count or amount exceeds the thresholds |

Type: Enum

Default: N

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar month |

“Y” For calculation using calendar months instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10020 |

1030 |

Monthly amount limit exceeded for sender |

10021 |

1031 |

Monthly quantity limit exceeded for sender |

Destination Credit Card Number usage frequency for last 24 hours (daily limit)

This check fires when the number or amount of transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Transfer transactions only in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 24 hours for this credit card used as Destination card |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last 24 hours for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 24 hours for this credit card used as Destination card |

Type: Int

Default: 99999

|

use calendar day |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10049 |

1059 |

Daily amount limit exceeded for recipient |

10050 |

1060 |

Daily quantity limit exceeded for recipient |

Destination Credit Card Number usage frequency for last 7 days (weekly limit)

This check fires when the number or amount of transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Transfer transactions only in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 7 days for this credit card used as Destination card |

Type: Decimal

Default: 99999999

|

calendar week starts from Sunday |

“Y”: calendar week starts from Sunday,

“N”: calendar week starts from Monday

|

Type: Enum

Default: N

|

for all merchant projects |

current total transactions amount or count for the last 7 days for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 7 days for this credit card used as Destination card |

Type: Int

Default: 99999

|

use calendar week |

“Y” For calculation using calendar weeks instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10051 |

1061 |

Weekly amount limit exceeded for recipient |

10052 |

1062 |

Weekly quantity limit exceeded for recipient |

Destination Credit Card Number usage frequency for last month (monthly limit)

This check fires when the number or amount of transactions associated with exact Destination credit card number exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Transfer transactions only in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last one month for this credit card used as Destination card |

Type: Decimal

Default: 999999999

|

check preauth transactions |

“Y” Prohibit preauth transactions when the quantity limit is reached, it is necessary to enable the filter and set the correct values of the limit on all projects where this functionality requires |

Type: Enum

Default: N

|

for all merchant projects |

current total transactions amount or count for the last one month for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last one month for this credit card used as Destination card |

Type: Int

Default: 99999

|

Use calendar month |

“Y” For calculation using calendar months instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10053 |

1063 |

Monthly amount limit exceeded for recipient |

10054 |

1064 |

Monthly quantity limit exceeded for recipient |

Total Credit Card Number usage frequency for last 24 hours (daily limit)

This check fires when the number or amount of transactions associated with exact credit card number used as Source or Destination exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 24 hours for this credit card used as Source or Destination |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last 24 hours for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 24 hours for this credit card used as Source or Destination |

Type: Int

Default: 99999

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar day |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10055 |

1065 |

Daily total amount limit exceeded for sender |

10056 |

1066 |

Daily total quantity limit exceeded for sender |

10057 |

1067 |

Daily total amount limit exceeded for recipient |

10058 |

1068 |

Daily total quantity limit exceeded for recipient |

Total Credit Card Number usage frequency for last 7 days (weekly limit)

This check fires when the number or amount of transactions associated with exact credit card number used as Source or Destination exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 7 days for this credit card used as Source or Destination |

Type: Decimal

Default: 999999999

|

calendar week starts from Sunday |

“Y”: calendar week starts from Sunday,

“N”: calendar week starts from Monday

|

Type: Enum

Default: N

|

for all merchant projects |

current total transactions amount or count for the last 7 days for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 7 days for this credit card used as Source or Destination |

Type: Int

Default: 99999

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar week |

“Y” For calculation using calendar weeks instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10059 |

1069 |

Weekly total amount limit exceeded for sender |

10060 |

1070 |

Weekly total quantity limit exceeded for sender |

10061 |

1071 |

Weekly total amount limit exceeded for recipient |

10062 |

1072 |

Weekly total quantity limit exceeded for recipient |

Total Credit Card Number usage frequency for last month (monthly limit)

This check fires when the number or amount of transactions associated with exact credit card number used as Source or Destination exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last one month for this credit card used as Source or Destination |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last one month for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last one month for this credit card used as Source or Destination |

Type: Int

Default: 99999

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar month |

“Y” For calculation using calendar months instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10063 |

1073 |

Monthly total amount limit exceeded for sender |

10064 |

1074 |

Monthly total quantity limit exceeded for sender |

10065 |

1075 |

Monthly total amount limit exceeded for recipient |

10066 |

1076 |

Monthly total quantity limit exceeded for recipient |

Purpose usage frequency for last 24 hours (daily limit)

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 24 hours for this Purpose |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last 24 hours for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 24 hours for this Purpose |

Type: Int

Default: 99999

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar days |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10040 |

1050 |

Daily amount limit exceeded for purpose |

10041 |

1051 |

Daily quantity limit exceeded for purpose |

Purpose usage frequency for last 7 days (weekly limit)

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 7 days for this Purpose |

Type: Decimal

Default: 999999999

|

calendar week starts from Sunday |

“Y”: calendar week starts from Sunday,

“N”: calendar week starts from Monday

|

Type: Enum

Default: N

|

for all merchant projects |

current total transactions amount or count for the last 7 days for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 7 days for this Purpose |

Type: Int

Default: 99999

|

Subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: Y

|

Use calendar days |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10042 |

1052 |

Weekly amount limit exceeded for purpose |

10043 |

1053 |

Weekly quantity limit exceeded for purpose |

Purpose usage frequency for last month (monthly limit)

This check fires when the number or amount of transactions associated with exact Purpose exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last one month for this Purpose |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last one month for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last one month for this Purpose |

Type: Int

Default: 99999

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar days |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10044 |

1054 |

Monthly amount limit exceeded for purpose |

10045 |

1055 |

Monthly quantity limit exceeded for purpose |

Email usage frequency for last 24 hours (daily limit)

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 24 hours for this Email address |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last 24 hours for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 24 hours for this Email address |

Type: Int

Default: 99999

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar days |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10073 |

1083 |

Daily amount limit exceeded for email address |

10074 |

1084 |

Daily quantity limit exceeded for email address |

Email usage frequency for last 7 days (weekly limit)

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 7 days for this Email address |

Type: Decimal

Default: 999999999

|

calendar week starts from Sunday |

“Y”: calendar week starts from Sunday,

“N”: calendar week starts from Monday

|

Type: Enum

Default: N

|

for all merchant projects |

current total transactions amount or count for the last 7 days for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 7 days for this Email address |

Type: Int

Default: 99999

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar days |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10075 |

1085 |

Weekly amount limit exceeded for email address |

10076 |

1086 |

Weekly quantity limit exceeded for email address |

Email usage frequency for last month (monthly limit)

This check fires when the number or amount of transactions associated with exact Email address exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last one month for this Email address |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last one month for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last one month for this Email address |

Type: Int

Default: 99999

|

Subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

Use calendar days |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10077 |

1087 |

Monthly amount limit exceeded for email address |

10078 |

1088 |

Monthly quantity limit exceeded for email address |

IP address usage frequency for last 24 hours (daily limit)

This check fires when the number or amount of transactions associated with exact customer IP address exceeds the configured thresholds. The time threshold is a 24 hours window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 24 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 24 hours for this IP address |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last 24 hours for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 24 hours for this IP address |

Type: Int

Default: 99999

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar days |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10100 |

1110 |

Daily amount limit exceeded for IP address |

10101 |

1111 |

Daily quantity limit exceeded for IP address |

IP address usage frequency for last 7 days (weekly limit)

This check fires when the number or amount of transactions associated with exact customer IP address exceeds the configured thresholds. The time threshold is a 7 days window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to hours. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in 168 hours. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last 7 days for this IP address |

Type: Decimal

Default: 999999999

|

calendar week starts from Sunday |

“Y”: calendar week starts from Sunday,

“N”: calendar week starts from Monday

|

Type: Enum

Default: N

|

for all merchant projects |

current total transactions amount or count for the last 7 days for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last 7 days for this IP address |

Type: Int

Default: 99999

|

subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

use calendar days |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10102 |

1112 |

Weekly amount limit exceeded for IP address |

10103 |

1113 |

Weekly quantity limit exceeded for IP address |

IP address usage frequency for last month (monthly limit)

This check fires when the number or amount of transactions associated with exact customer IP address exceeds the configured thresholds. The time threshold is a one month window calculated backwards from the moment of the transaction. For window calculation all transaction dates are truncated to days. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 transactions, it fires on the 11th transaction in one month. Month calculation based on calendar i.e. 28th, 29th, 30th and 31st of March would be bumped to 28th of February during window calculation. Counts Sale, Preauth or Transfer transactions in the approved status.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

amount limit |

maximum total transactions amount for the last one month for this IP address |

Type: Decimal

Default: 999999999

|

for all merchant projects |

current total transactions amount or count for the last one month for this credit card value would be calculated: - Y: for all projects - 3DS: for 3DS gates only - Non-3DS: for non-3DS gates only - N: for current project only of the current merchant and converted to current project currency to compare with amount or quantity limit values |

Type: Enum

Default: Y

|

quantity limit |

maximum total transactions count for the last one month for this IP address |

Type: Int

Default: 99999

|

Subtract Cancel transactions |

subtracts Cancelled transactions from the calculated count and amount thresholds |

Type: Enum

Default: N

|

Use calendar days |

“Y” For calculation using calendar days instead of calculation from moment when filter was enabled “N” for calculation from moment when filter was enabled |

Type: Enum

Default: N

|

Error codes

# |

Code |

Name |

|---|---|---|

10104 |

1114 |

Monthly amount limit exceeded for IP address |

10105 |

1115 |

Monthly quantity limit exceeded for IP address |

Source Credit Card Number usage frequency for Purpose

This check fires when the number of Source Credit Cards associated with exact Purpose exceeds the configured thresholds. The time threshold is a moving window calculated backwards from the moment of the transaction. The risk fires on the transaction after the set threshold. So, if you set a threshold of 10 Credit Cards in 6 hours, it fires on the 11th unique Credit Card in 6 hours. Counts unique Source Credit Card numbers for Account verification, Sale, Preauth or Transfer transactions in any status for the current Merchant.

Score: Yes

Enabled by default: N

Parameters

Name |

Description |

Value |

|---|---|---|

checking interval in hours |